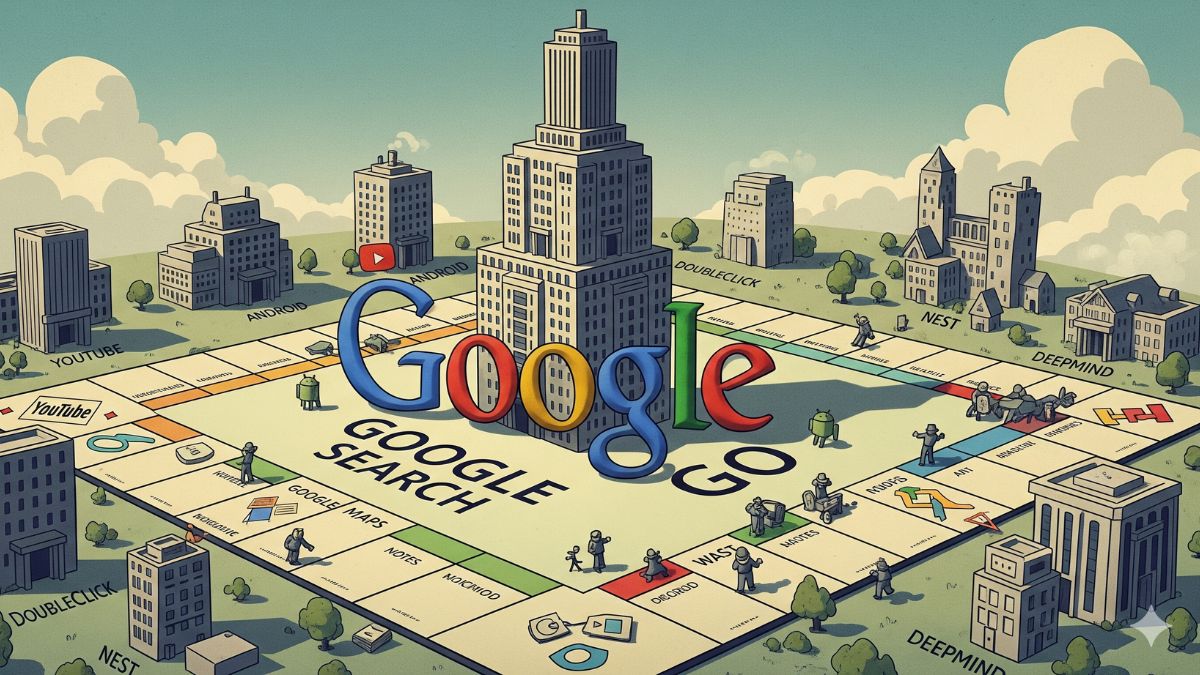

Federal Judge Amit Mehta ruled that Google, owned by Alphabet, engaged in illegal monopolistic practices in the online search market. The ruling is considered one of the most significant in the recent history of the U.S. judiciary regarding digital monopolies.

Despite this verdict, the company avoided the harshest penalties sought by the Department of Justice, meaning it will not have to sell its Chrome browser or decouple its search engine from the Android operating system, which would have dealt a major blow to the digital ecosystem it has built.

ALSO READ. Google AI Mode reaches 180 countries: what does it mean for SEO?

The court ruling requires Google to allow competitors access to certain search data to open up the market to competition. It also prohibits the company from entering into exclusive agreements with device manufacturers that prevent the pre-installation of rival products such as search engines or digital assistants. The ruling specifies that these restrictions also apply to products like Google Search, Chrome, Google Assistant, and the artificial intelligence app Gemini.

Why was Google accused of being a monopoly?

The legal battle began in 2020 when the U.S. Department of Justice and a group of states sued Google for maintaining an illegal dominance in the digital search market. According to Judge Mehta: “Google is a monopolist and has acted as one.”

During the ten-week trial in 2023, evidence showed that Google spent more than 26 billion dollars in 2021 to secure its search engine as the default on browsers like Safari and Firefox. This created a vicious cycle: more users accessed Google, the company collected more data, and its competitive advantage grew.

Prosecutors also alleged that Google was trying to expand its dominance into the field of artificial intelligence, a rapidly growing industry with players like OpenAI, Anthropic, and Perplexity competing to redefine digital search.

What was the judge’s verdict against Google?

Judge Amit Mehta issued a 230-page decision outlining structured but conservative remedies. Among the key rulings:

- Google must share certain search data with qualified competitors.

- Exclusive contracts are prohibited if they prevent manufacturers and carriers from offering alternatives to Google products.

- Google is not required to sell Chrome, its most popular browser, or to decouple its search engine from Android.

Regarding the request for forced divestiture, the judge was clear: “Los demandantes se excedieron al solicitar la desinversión forzosa de estos activos clave, que Google no utilizó para imponer restricciones ilegales.”

How did Google react to the ruling?

Although it avoided drastic sanctions, Google was not satisfied with the ruling. CEO Sundar Pichai had warned in April that sharing data with rivals could facilitate reverse engineering of its technology. Google has already announced its intention to appeal, meaning it could take years before concrete measures are implemented.

During the trial, Google claimed it had loosened some agreements with companies like Samsung, Motorola, AT&T, and Verizon, allowing the inclusion of rival search engines. However, U.S. authorities determined that these actions were not enough to counteract its already established dominance.

Why did the market react positively even though Google lost?

Paradoxically, the stock market responded positively to the ruling. Investors had feared a forced breakup of Google’s core business units, something that was ultimately dismissed. The continued ownership of Chrome and its connection to Android preserve the company’s main sources of traffic, revenue, and data.

Additionally, the fact that the ruling allows Google to maintain certain contracts and business models, albeit with modifications, sends a signal of stability. The measures, while significant, do not represent a radical change to the company’s structure.

Monopoly cases against Google in Europe

Google is not only under pressure in the United States. In Europe, the European Commission has sanctioned the company on several occasions. The most notable was in 2017, when it imposed a fine of 2.424 billion euros for favoring its product comparison service, Google Shopping.

In 2024, European courts upheld the validity of that fine, prompting a reaction from current U.S. President Donald Trump, who accused the European Union of acting in bad faith against American digital companies.

Additionally, other legal proceedings are underway in Virginia and Texas against the search giant for monopolistic practices in the ad server market and for harming media outlets through its advertising platforms.